Netflix stock is a stock that has been on the rise since it was first introduced to the public in 2011. In this article, I will show you how to make the most of your Netflix stock investing strategy by using technical analysis.

1: What Is Technical Analysis?

Technical analysis is a tool used by traders and investors to help determine the direction of a security or commodity price. It is based on the premise that stock prices can be predicted by studying past prices and movements, and that these patterns can be used to make informed investment decisions.

2: How Do You Use Technical Analysis In Your Investing Strategy?

Technical analysis is a way of analyzing financial data in order to forecast future stock prices. It involves studying charts and patterns to determine the direction of a stock’s price movement. Technical analysts use this information to make decisions about whether or not to buy or sell stocks.

Many people use technical analysis in their investing strategy because it can help them predict when a stock is overvalued or undervalued. Overvalued stocks are those that are worth more than what the market is willing to pay for them, and undervalued stocks are those that are worth less than what the market is willing to pay for them.

When you find a stock that is overvalued, it’s important to sell it before it becomes too expensive and invest your money in a more undervalued stock.

When you find a stock that is undervalued, it’s important to buy it before the market corrects its price and invest your money in a more overvalued stock.

There are several factors that can affect the price of a stock, including economic conditions, company performance, and global events. Technical analysts often use these factors to predict when they will enter or exit the market. They also use technical indicators such as Bollinger

3: What Are The Signs Of A Bullish Market?

A bullish market is one where the prices of stocks are increasing. This means that investors believe there is potential for future growth in the company or industry. Some signs that a market may be in a bullish phase include:

1) The Dow Jones Industrial Average (DJIA) is seeing consistent gains.

2) The S&P 500 Index is up significantly from its previous levels.

3) Volume of trading is high, indicating that investors are optimistic about the market’s future.

4) Companies with strong fundamentals are doing well, regardless of the stock market’s direction.

5) Economic indicators show that the economy is growing, which benefits stocks in general.

4: What Are The Signs Of A Bearish Market?

The stock market is a complex and ever-changing system and can be hard to understand for the average person. However, there are some general indicators that can help you discern when the market is in a bearish trend.

1) When stocks are falling in value, it’s usually because there is increased pessimism about the future. This means that investors are no longer confident in the companies’ prospects, which will cause their share prices to decline.

2) Another sign of a bear market is when fewer companies are making gains. This indicates that investors are concerned about too many risks associated with specific investments and are instead focusing on safer bets. In other words, it’s harder to find good investment opportunities during a bear market because everyone seems to be selling at once.

So if you’re worried about your stock portfolio or just want to get an idea of where the market may be headed, keep an eye out for these two indicators – they could give you some valuable insights into how things might play out over the next few months or years.

How To Invest In Netflix Stock NFLX ? Best Tips To Boost Your Netflix Stock Investment Career 2022

5: How To Determine If There Is Going To Be An Increase Or Decrease In Demand For Netflix Stock.

Netflix has been a huge player in the streaming industry for many years now. The company has released several hit series such as House of Cards, Stranger Things, and Narcos. In addition to releasing popular series, Netflix also produces its own content including documentaries and original movies.

Recently there have been some concerns about the future of Netflix. Some analysts are predicting that there will be an increase in demand for Netflix stock as more people switch to streaming services instead of watching TV shows and movies on traditional cable channels. Others believe that there will be a decrease in demand for Netflix stock as people turn away from streaming services in favor of traditional cable TV.

It is impossible to know exactly what the future holds for Netflix stock, but it is important to stay tuned because this company is sure to continue making waves in the entertainment industry.

6: When Should You Buy And Sell Netflix Stock?

Netflix is a technology company that provides streaming video and audio services over the internet. The company offers its services through a subscription model, and it has been growing rapidly since it was founded in 1997. In 2016, Netflix generated $8.7 billion in revenue, and it expects to generate $11 billion in revenue this year.

How To Buy Gme Stock: 8 Tips To Make The Right Decision when Gme Stock Split

Netflix stock is trading at around $385 per share, which makes it a relatively inexpensive stock to invest in. However, given the growth potential of the company, investors may want to consider buying Netflix stock if they are interested in investing in a technology company with strong potential for growth. Additionally, investors may want to sell Netflix stock if they are concerned about the growth prospects of the company or if they think that the stock price is too high.

So, when should you buy Netflix stock and when should you sell it? This is a difficult question to answer because it depends on a variety of factors, including the growth prospects of the company and your individual financial situation.

However, investors generally want to hold stocks for at least six months and preferably for a year or more. So, if you’re thinking about buying Netflix stock, it may be best to wait until the price has settled down before making your purchase.

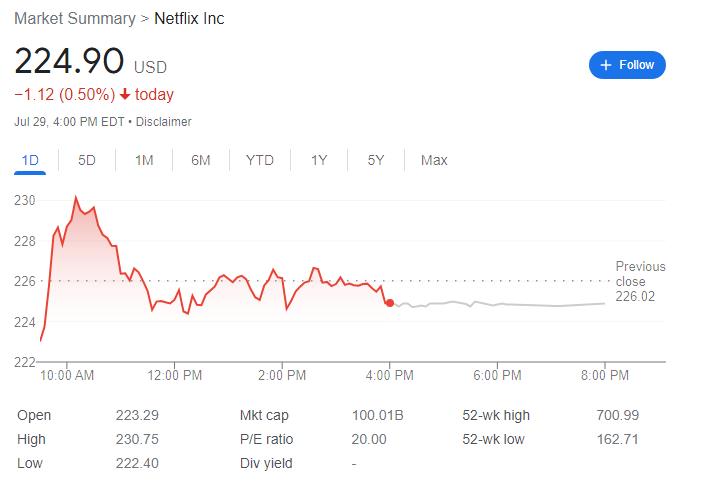

6.1: Why Is Netflix Stock Down?

Netflix stock has been on the decline lately because of a number of reasons. First, there is an overall slowdown in the streaming industry as a whole. This has led to decreased viewership for Netflix, which means that people are not spending as much money on its products.

6.2: Should I Buy Netflix Stock?

If you are comfortable with the risks involved, then you should absolutely buy Netflix stock. However, you should do your research first to make sure that this is the right decision for you. Remember that investing in stocks can be risky, so always be prepared for the possibility of losing your investment.

Conclusion

As you can see from this article, there are many ways to make the most of your Netflix stock investing strategy. By using technical analysis, you can determine if there is going to be an increase or decrease in demand for Netflix stock. If there is going to be an increase in demand, then it would be a good time to buy and sell Netflix stock.

Foolproof Rules To Navigate The Nio Stock Market And Profit Predictions 2025